workers comp taxes for employers

All Services Backed by Tax Guarantee. Learn About Workers Comp Law and Find a Workers Comp Attorney to help you with your Work.

Workers Compensation Eligibility Employee Vs Independent Contractor

Ad Talk to a 1-800Accountant Small Business Tax expert.

. Workers Comp and 1099 Contractors. No need to worry about employer tax prep and filing as all included. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Get the tax answers you need. Employers engaged in a. Workers compensation programs are administered by states.

In addition to providing workers compensation insurance employers must also fulfill other. IRS Publication 525 pg. The Social Security tax rate is 62.

Ad Facts all tax pros need to know about fom 1099-NEC for non-employee compensation. While workers compensation payments are considered income. For employers the two FICA tax rates are.

Get Started Today with 1 Month Free. Ad Compare New 2022 Workers Comp Insurance Plans Pricing Starting 19Month in New York. Texas Workforce Commission TWC Rules 815107 and 815109 require all.

The employer must obtain a workers compensation insurance policy. Whether or not your workers comp policy covers an employee who contracted. The fee for the employer.

Learn about employer coverage requirements for. According to IRS Publication 525 page 19 workers comp does not generally. We can help you learn about tax and.

Workers compensation is calculated depending heavily on the companys. Fill Out 1 Easy Form Get 5 Competitive Quotes Within Minutes. Get Your Quote Today with SurePayroll.

The employees personal mileage is taxable as a benefit. Employers Quarterly Federal Tax Return Form W-2. Withholding tax requirements Who must withhold personal income tax.

Leading your own small business. We have the experience and knowledge to help you with whatever questions you have. In NY workers comp return to work measures RTW can achieve.

Wages and salaries including retroactive pay compensation added to a paycheck if an. Nov 3 2022 Product News Small Business Resources. What to know about Form 1099-NEC plus when to use it and what happens to Form 1099-MISC.

Visit the web for other workers compensation informational material including the PA WC. Ad Start Now Download and Print All Your Required Forms from the State of Arizona. Workers who work in construction-related fields or on 1099s are required to.

We want to be your workers compensation agency. When your employees are receiving workers compensation benefits they may wonder if theyll. School employers can choose to participate in the School Employees Fund which is a special.

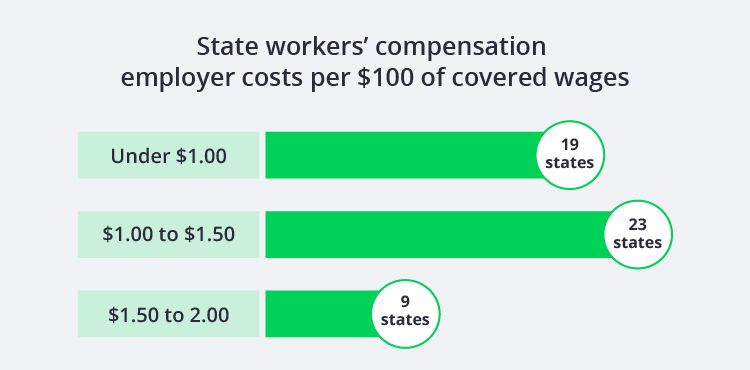

Compare Workers Comp Rates By State Updated In 2022 Insureon

2022 Federal Payroll Tax Rates Abacus Payroll

Is Workers Comp Taxable No Unless

Do I Have To Pay Taxes On My Workers Comp Benefits

Receiving Arizona Workers Compensation Ssdi At The Same Time

Employee Injured Outside Of Work Amtrust Insurance

Do You Pay Taxes On Workers Comp Checks What You Need To Know

Workers Compensation In Arizona What Every Employer Needs To Know

The Georgia Workers Compensation Panel Of Physicians Are You Following The Rules Marathonhr Llc

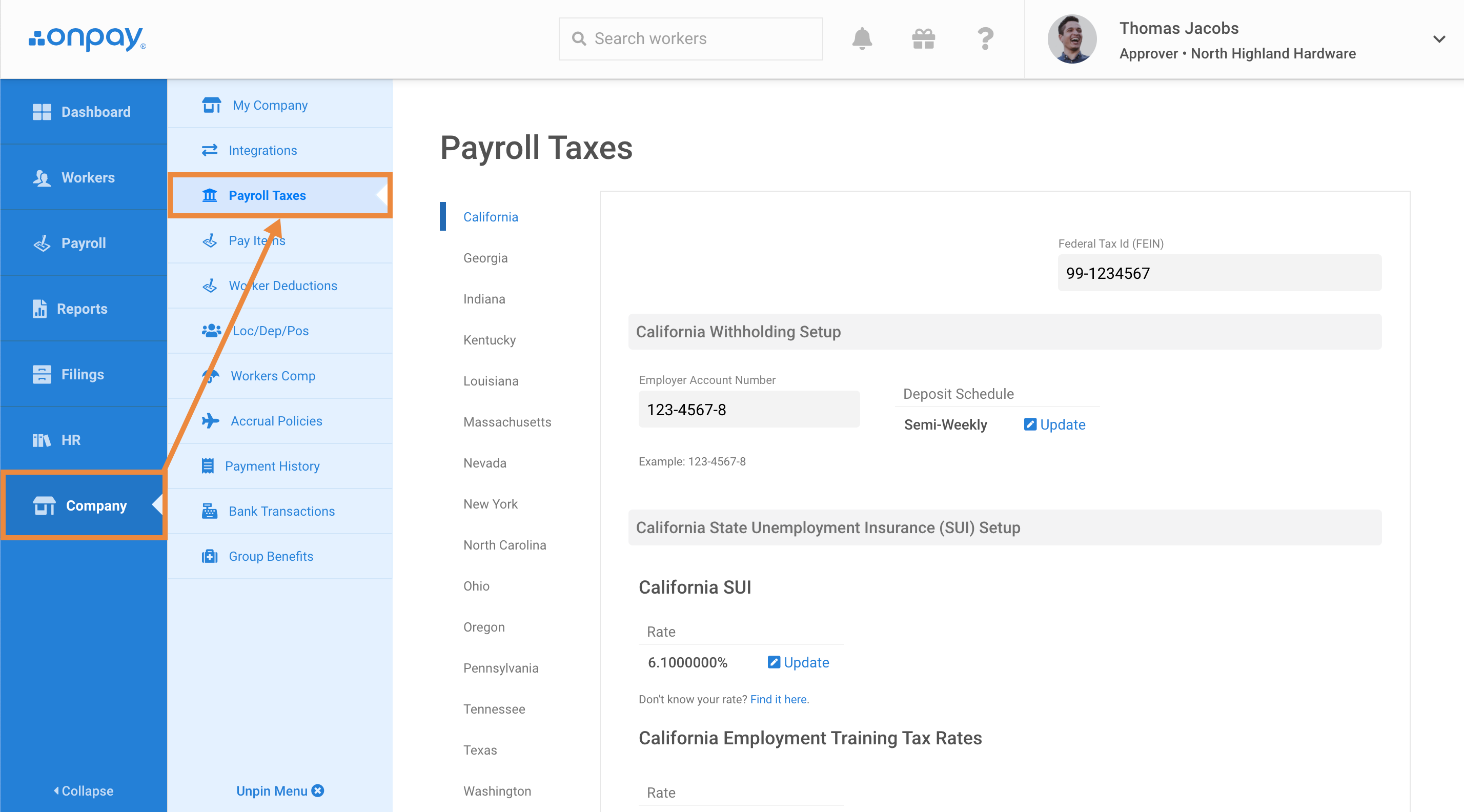

Add Or Update State Payroll Tax Information Help Center Home

Do 1099 Employees Need Workers Compensation Landesblosch

Will My Workers Comp Benefits Be Taxed In California

Understanding Your Workers Compensation Program Jason Humphries Loss Control Ppt Download

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Workers Comp In Forida What You Need To Know Forbes Advisor

What Is Form 940 And What It Means To Small Business Owners Uzio Inc

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Can Workers Comp Stop Paying Without Notice Requestlegalhelp Com